average property tax in france

Corporation tax in France. This is payable at the end of each year in December and can also be paid monthly.

Average Appraisal Is Half Of A Percent Less Than Expected Rocket Mortgage Press Room Quicken Loans Home Refinance Home Appraisal

For French non-residents taxes will usually be taken on France-sourced incomes at a 30 tax rate.

. If you do not have a TV or similar device computers with online subscriptions such as Netflix do not count you can receive an exemption for this by checking the relevant box on your annual tax return. The first-year reduction of 30 per cent applies to. The rate of stamp duty varies slightly between the departments of France and significantly depending on the age of the property.

Property Tax Assistant salaries vary drastically based on experience skills gender or location. The standard rate is. The Personal Income Tax Rate in France stands at 45 percent.

Sometimes these charges will include heating of your water and your apartment so make sure you find out. If you were to just take taxes into account French taxes would actually be. This page provides the latest reported value for - France Personal Income Tax Rate - plus.

If you own a French apartment you will have monthly charges for the maintenance of the building elevator etc it all depends on the building you live in and you are typically billed every 3 months. Direction Générale des Finances Publiques. For properties more than 5 years old stamp duty is 58 or 509 in some departments.

Depending on when you purchase a property in France and your personal circumstances you may benefit from the French governments plans to phase out of the taxe dhabitation which began in January 2018. A person working as a Property Tax Assistant in France typically earns around 39500 EUR per year. This is the average yearly salary including housing transport and other benefits.

As a result of simultaneous changes to the liability for social charges since 2019 the combined rate of social charges and income tax on French sourced income of EEA non-residents is 275 down from 372 provided the income does not exceed the above threshold. Rental and related investment income from France and taxable in France beyond this level is taxed at 30. While Taxes in France appear to be extremely high at first glance you should keep in mind that the French make a clear distinction between taxes and social contributions.

As a result the data exclude property taxes paid by businesses renters and others. For property tax on the earnings from the sale of properties in France rates are set to 19 for all EU citizens and 3333 otherwise. It concerns about one-third of French companies.

The rate ranges from. Taxe sur la valeur ajoutée or TVA VAT in French is a tax on certain goods and services which is included in the sale price. These include a departmental tax usually 45 of the purchase price as well as a communal tax at the rate of 120 and another government charge of 237.

This tax is actually comprised of the. Salaries range from 18200 EUR lowest to 62800 EUR highest. In 2021 this tax is set at 138 per year in mainland France.

Property owners in France have two types of annual tax to pay. As the table above illustrates this means in simple terms that the maximum personal income tax rate in France in 2020 is 49 45 4. Income Tax Rates and Thresholds Annual Tax Rate.

Compliance for individuals Penalties. The corporate tax in French impot sur les societes IS is an annual tax in principle that affects all profits made in France by corporations and other entities. Taxes on goods and services VAT in France.

Email your questions to editors. Monthly Charges Charges Mensuelles. However there are reduced French TVA rates for certain pharmaceuticals public transport hotels restaurants and tickets to sportingcultural events.

This is a land tax and and is always paid by whoever owns the property on January 1st of any given fiscal year. Personal Income Tax Rate in France averaged 4707 percent from 1995 until 2020 reaching an all time high of 5960 percent in 1996 and a record low of 2250 percent in 2015. Obviously all countries have a different way of calculating taxes and different tax segments.

Nonresidents must pay tax on their property in France unless they are exempt under a tax treaty. The figures in this table are mean effective property tax rates on owner-occupied housing total real taxes paidtotal home value. Fines are applicable for any false declarations.

Social security Social security contributions and surcharges are deducted at source from salary payments with contributions of approximately 20 for the employee. Married Joint Tax Filers. The standard TVA rate in France is 20.

Homes with a net taxable worth of over 13 million US16 million are subject to the tax although debt on the property and taxes already paid may reduce the taxable amount. France Non-Residents Income Tax Tables in 2020. For properties less than 5 years old stamp duty is 07 plus VAT at 20.

Therefore to compare these two countries lets take the salaries of someone who gains 28 000 a year about 33 000 45 000 a year about 53 000 and 113 000 a year about 132 500 and see how much they have left after taxes in each country. Rates are progressive ranging from 05 to 15. The figure is based on the rental value of the property and the rate of tax is determined annually by the authority.

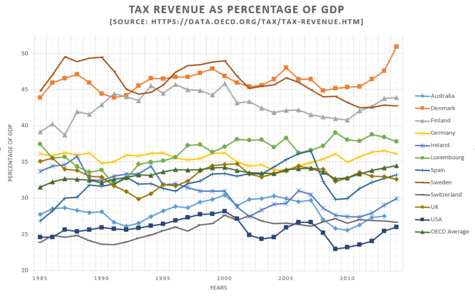

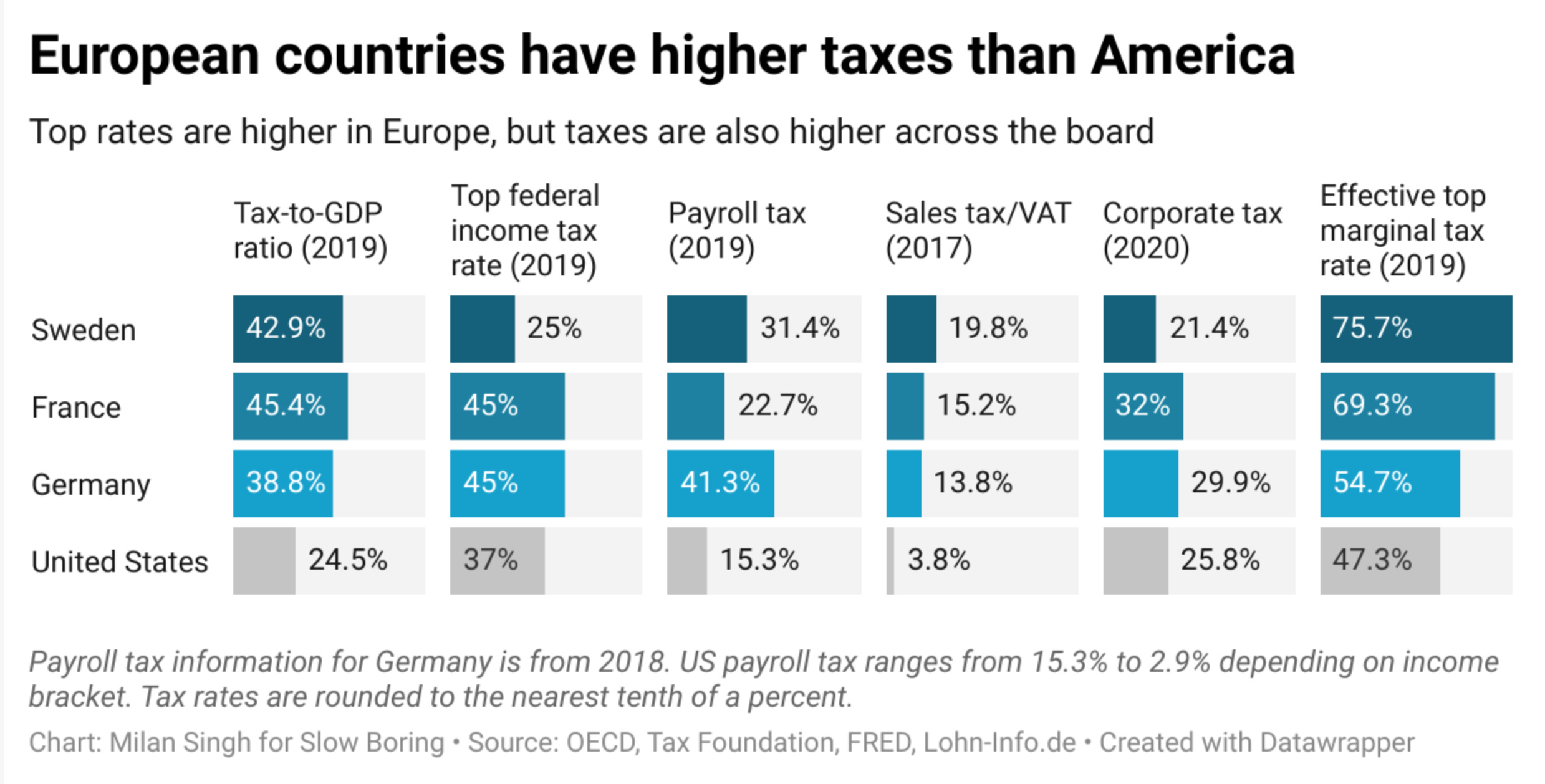

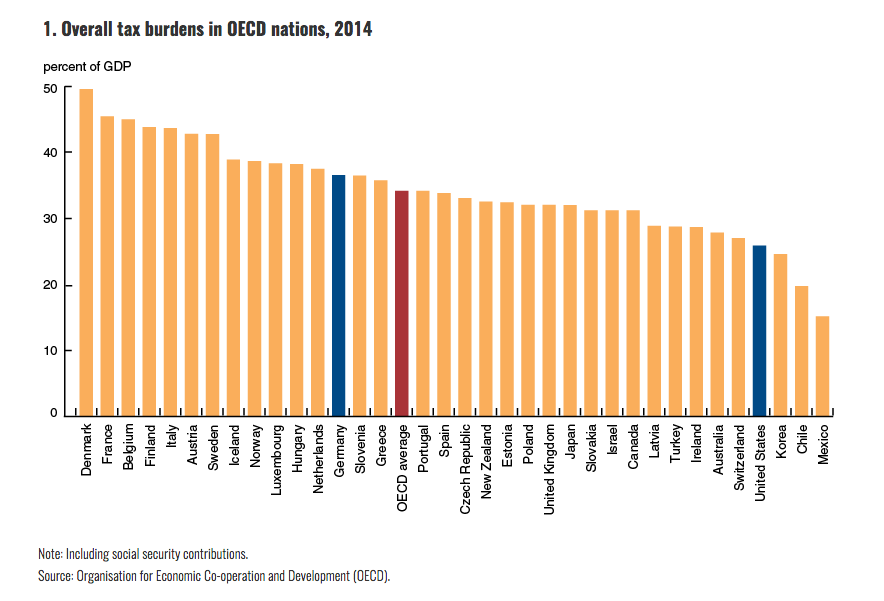

European Countries Have Really High Taxes

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

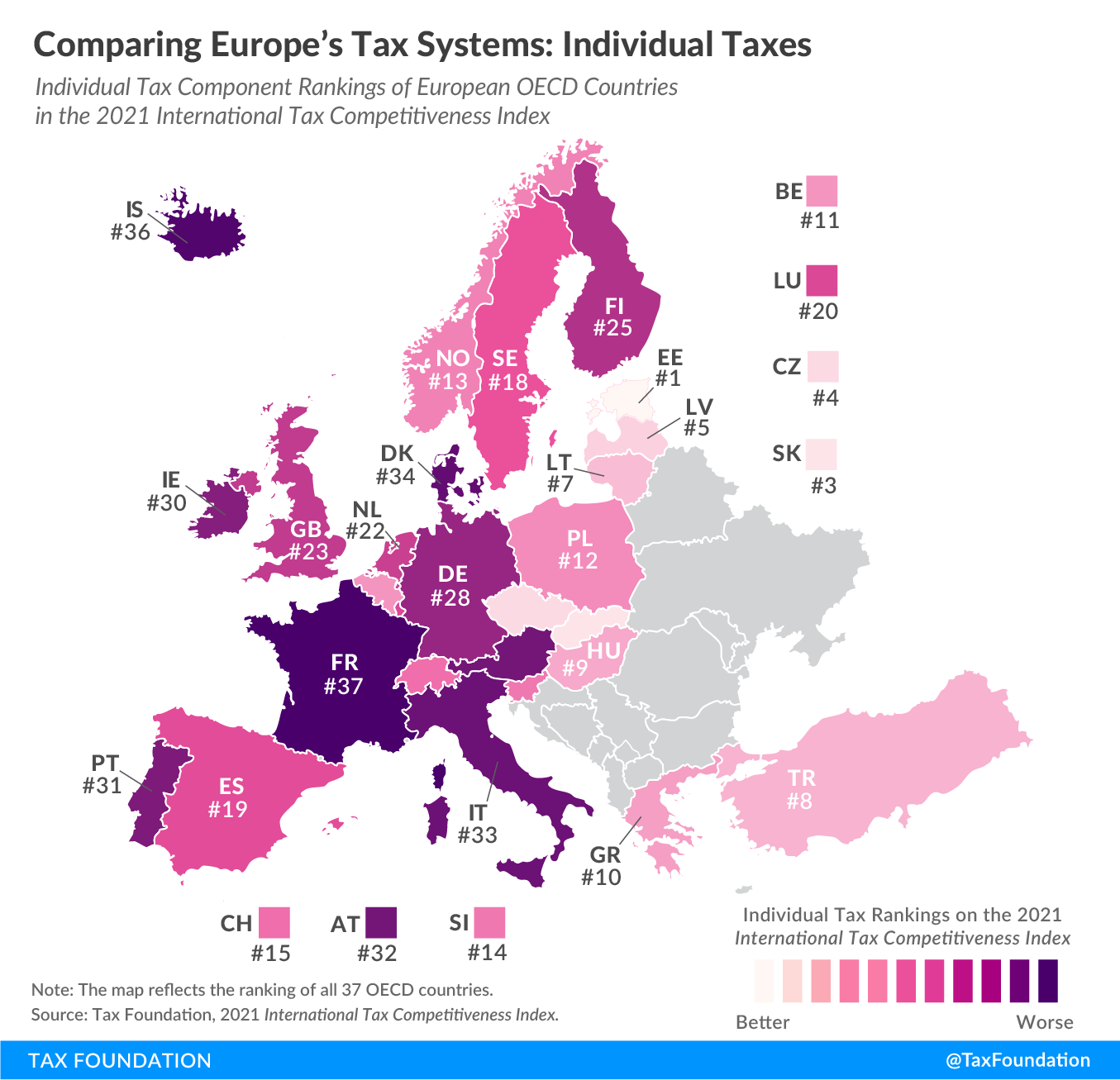

Comparing Income Tax Systems In Europe 2021 Tax Foundation

How Well Funded Are Pension Plans In Your State Tax Foundation Pension Plan Pensions How To Plan

This Map Shows How Taxes Differ By State Gas Tax Healthcare Costs Better Healthcare

Tax Day2015 Tax Day Real Estate Infographic Real Estate Fun

Who Pays More In Taxes U S Vs Europe Developed Countries Money

Pin By Oscarin Rendon On Random Lovelies And Awesomeness Unique Houses Building Paris France

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

Income Tax In The Uk And France Compared Frenchentree

Our Infographics Motivation Famous Motivational Quotes Motivational Thoughts

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times

U S Tax Refunds Down Nearly 9 Percent Vs Year Ago Irs Data Irs Tax Forms Irs Forms Irs Taxes

Pin On House Hunting News Greece

Top Personal Income Tax Rates In Europe 2022 Tax Foundation

What Would The Tax Rate Be Under A Vat Tax Policy Center

Ecuador El Mejor Lugar Para Migrar Expat Destinations Infographic Ecuador Expat Cool Countries

Interaction Of Household Income Consumption And Wealth Statistics On Taxation Statistics Explained